LAO Publication: The 2025-26 Budget – Overview of the Spending Plan

Back to News

On October 16, the Legislative Analyst’s Office (LAO) published its annual summary of the state’s spending plan for the 2025-26 fiscal year.

As the California Legislature’s nonpartisan fiscal and policy advisor, the LAO issues an annual California Spending Plan publication that provides an independent overview of the budget adopted by the Legislature and the Governor for this fiscal year. This publication also includes a brief description of how the budget process unfolded and highlights major features of the budget. (See CSAC’s Budget Action Bulletins and Advocacy letters for the 2025-26 Budget here.)

The State’s “Budget Problem”

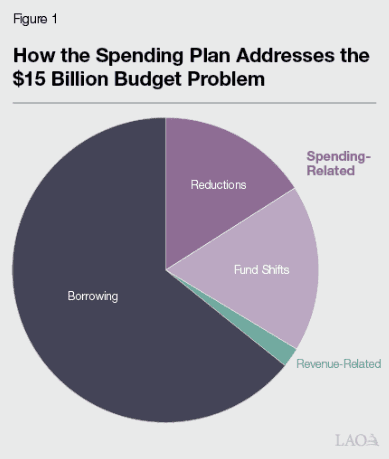

Included in this year’s report is a breakdown of the actions taken to address an estimated $15 billion deficit—referred to as a “budget problem”— in the 2025-26 budget package. These actions include $10 billion in borrowing, $5 billion in spending-related solutions, which include spending cuts and fund shifts, and $300 million in revenue-related solutions resulting from new rules for determining taxable profits for multistate financial institutions.

LAO: “The State’s New Wall of Debt”

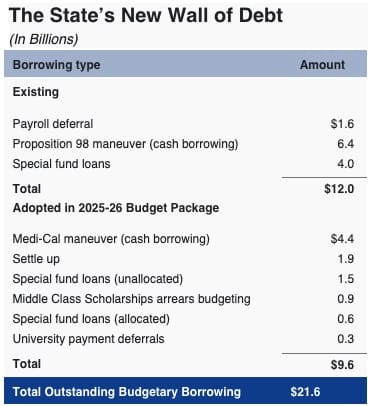

The $10 billion in new borrowing built into this year’s spending plan is projected to almost double the state’s total outstanding budgetary borrowing from roughly $12 billion to $22 billion. In its report, the LAO compares these borrowing measures to those used during the Great Recession, titling a breakdown of the current outstanding budgetary borrowing, “The State’s New Wall of Debt.

Multiyear Budget Problem

The 2025-26 budget package also takes steps to partially address the state’s multiyear budget deficits. This includes ongoing budget solutions totaling $11 billion—composed of $10.5 billion in ongoing spending solutions (reductions, mainly in the health area) and $300 million in ongoing revenue increases. However, even with these solutions, multiyear deficits are expected to persist and will need to be addressed in future budgets. The LAO notes that multiyear estimates—particularly revenue projections—are subject to considerable uncertainty. Revenue estimates can vary by billions of dollars in the near term and by tens of billions of dollars in later years. As such, these estimates should be interpreted cautiously.

More Budget Publications on the Horizon

This November, keep an eye out for the LAO’s annual Fiscal Outlook publication for a forecast of the state’s budget condition for the 2026-27 fiscal year and beyond. This annual report will include the LAO’s assumptions about the state’s economy for fiscal years 2026-27 through 2029-30 and how the state’s economy affects the state’s annual revenues and expenditures. As state and federal funds account for nearly half of county revenue on average, fiscal forecasts and analysis of the state’s economic condition can help counties prepare balanced and sustainable budgets. You can receive an email notification when the LAO publishes the 2026-27 Fiscal Outlook by subscribing to the LAO news releases.

The Department of Finance also releases a Finance Bulletin every month except in January and May. The monthly bulletin, introduced in 2009, is an economic update and cash report that notes state and national economic trends and information about cash receipts. For instance, the October 2025 Finance Bulletin shows that actual General Fund revenues came in 11.9 percent higher than projected for September. This was entirely due to personal income tax cash receipts for the month being 21.4 percent over those projected by the 2025-26 spending plan. As mentioned above, revenue projections are subject to considerable uncertainty so despite these increases in revenue, California’s budget condition remains fragile. You can receive an email notification when the newest edition of the finance bulletin is published by subscribing to the finance bulletin mailing list.